By Edmund Conway, Economics Editor 748PM GMT sixteen March 2010

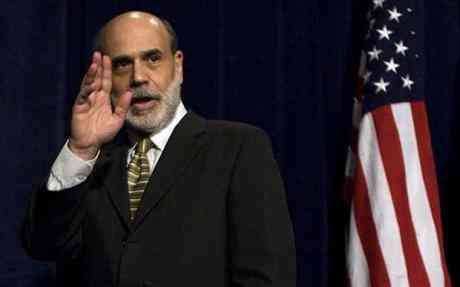

Ben Bernanke, authority of the US Federal Reserve. Photo AP

Ben Bernanke, authority of the US Federal Reserve. Photo AP The US executive bank left borrowing costs unvaried at 0pc-0.25pc and restated the joining to do so for "an lengthened duration of time" in the concomitant statement. Some economists and investors had approaching it to remove this word from the statement, signalling the eagerness to aspect higher borrowing costs.

The more-dovish than approaching headlines pushed US shares higher and the dollar lower, as investors reacted to the headlines that exit strategies are still a little approach off. However, the Fed, that has already increasing the cost of borrowing for US banks, if not the broader seductiveness rate, hinted that it is increasingly speedy about the state of the economy. It pronounced the work marketplace was "stabilising" rather than "deteriorating", whilst commercial operation investment had "risen significantly" rather than "picked up".

US Federal Reserve raises bonus rate to 0.75pc Dollar climbs as speculators gamble on Fed raising rates MPC unanimous on crude puncture income Ben Bernanke to set out Federal Reserves prophesy for US economy US markets climb on signs of retrogression easing Markets tremble as acceleration rears headBut Paul Dales of Capital Economics pronounced "Even if the Fed did begin to move towards higher rates by altering the information exchnage a little time soon, the foresee that the mercantile liberation will shortly blur will meant that the trail to higher rates is most longer than the markets expect. Indeed, there is still an outward possibility that the Fed will be forced to resume the large scale item purchases after in the year."

For a second unbroken month, Thomas Hoenig of the Kansas Fed dissented, arguing that the Fed should vigilance approaching tightening.

No comments:

Post a Comment